LOS ANGELES, June 28, 2025 (GLOBE NEWSWIRE) —

After evaluating each lender, we have selected Low Credit Finance as the number one choice. We have also examined each of the loan companies and highlighted why we feel they are the right choice for you. See the table below to see how we have scored each lender.

Are you facing financial difficulties and urgently need some extra cash to meet your expenses before you receive your paycheck? Given the challenging economic times, securing a loan from a conventional lender can be daunting, especially if you have a less-than-ideal credit history.

However, we have some reassuring news: we have a dedicated team that has diligently combed through the US lending landscape to identify leading lenders who specialize in offering payday loans without credit checks to individuals with poor credit.

These payday loans no credit checks can provide solutions that serve as a lifeline, offering the much-needed financial support to tackle unforeseen expenses or bridge the financial gap between paychecks.

Below is our recommended lender for payday loans without credit checks.

Payday Loan No Credit Check US

With just a simple tap, you can easily pick the company that aligns most with your needs and obtain the payday loan no credit check is required to handle your unpaid expenses or unforeseen costs or bridge the financial divide between the application time and your next payday.

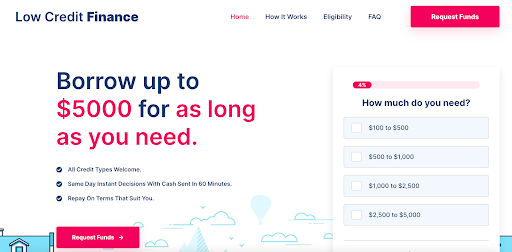

If you’re seeking a payday loan with no credit check, you’ll want a lender that caters to various credit scores. Look no further than Low Credit Finance. Their streamlined application process for payday loans takes just about two minutes to complete.

On their online platform, a vast array of lenders are eager and prepared to offer payday loans no credit check up to $5,000. It’s worth noting their transparency in operations, ensuring borrowers there are no hidden fees, which makes the loans accessible and affordable for all.

Also, when it comes to repayments, Low Credit Finance presents highly flexible terms, allowing borrowers extended durations to manage their finances and make timely payments.

Features of Low Credit Finance

- No credit checks are done on payday loan lenders.

- It offers affordable loans.

- No hidden charges on payday loans.

- Easy and convenient payday loan application.

- Flexible repayment terms.

Understanding Payday Loans No Credit Check

A payday loan no credit checks is an unsecured form of a short-term financial alternative that has been designed primarily for individuals facing urgent financial needs with limited alternatives. It diverges from conventional lending norms in the sense that it grants individuals with limited credit histories and poor credit scores payday loans with little to no credit assessment since the approvals are made based on the borrower’s ability to repay the loan as opposed to their credit ratings.

Contrary to conventional loans, payday loans no credit checks are offered by online lenders that provide a convenient and accessible platform for those in need of immediate cash. The process of getting one is smooth, and it takes a short time to access the approved funds as the process is done online, from application to disbursement of funds.

However, convenience comes at a cost as it often comes with relatively high fees and interest rates. Additionally, the regulation of payday loans no credit checks operates in a gray area as they are not subject to the same laws and protections across all the states as other types of conventional loans. Therefore, this lack of regulation means that you must exercise caution and due diligence when considering these loans, ensuring you fully understand the terms of getting payday loans no credit checks in your state.

How to Qualify for Payday Loans No Credit Check

To qualify for a payday loan with no credit check, you must meet several key eligibility criteria. Here’s a breakdown of these essential qualifications:

- Age and citizenship – You must be at least 18 years old and either a US citizen or a permanent resident to ensure that you meet the legal age and residency standards to access these loans.

- Income verification – Having a verifiable source of income is a crucial aspect as lenders require evidence of a consistent income source to ensure you have the means to repay the loan. This income could come from employment, benefits, or another reliable source.

- Debt-to-income ratio – Maintaining a favorable debt-to-income ratio is a significant criterion as lenders assess this ratio to evaluate your ability to manage additional debt responsibly. Thus a lower debt-to-income ratio is favorable.

- Bank account – You must possess a bank account that serves multiple functions, such as receiving fund deposits and facilitating automatic deductions for loan repayments, as required by the lender.

- Contact information – You must have a valid email address and/or phone number from which the lender will use as a means of communication with you throughout the application and repayment processes.

Meeting these eligibility criteria ensures that you are in a strong position to qualify for a payday loan with no credit check. Also, since all the above qualifications are easy to meet, payday loans no credit checks have high approval rates.

If you meet all these qualifications, below is the process you can follow to get a payday loan no credit check from any of our recommended lenders.

How to Apply for A Payday Loan No Credit Check

In contrast to traditional loans, obtaining a payday loan no credit check is a notably straightforward process, and extensive credit checks are not a prerequisite. Additionally, with the widespread availability of the Internet, applying for a payday loan no credit check has become significantly more convenient, eliminating the need for paperwork and long queues. Here is a step-by-step guide to applying for a cash advance:

- Select a payday loan no credit check provider from the recommended list.

- Allow the system to verify and evaluate your application.

- Receive notification of your application’s approval status from the lender.

- Access the approved cash advance funds directly in your bank account.

Whether you’re a seasoned borrower or a first-time applicant, rest assured that the application process is designed to be user-friendly. The interfaces are thoughtfully streamlined to ensure a seamless user experience, so you won’t encounter any hurdles while navigating through the process.

Advantages and Disadvantages of Payday Loans No Credit Check

Pros

- Fast and easy – Payday loans no credit checks provide a quick and simple way to obtain funds, making them one of the fastest and simplest lending options available.

- Accessibility for poor credit – Payday loans with no credit check are accessible even if you have a less-than-ideal credit history, as lenders prioritize your current financial situation and repayment capacity over credit scores.

- No employment requirement – You can access a payday loan with no credit check even if you are currently unemployed, as lenders consider alternative sources of income to assess your ability to repay.

- No income restrictions – Having a low income does not disqualify you from obtaining a payday loan with no credit check.

- Flexible repayment terms – These loans offer flexible repayment periods, which can be extended to accommodate your financial circumstances.

- Improved future loan options – Demonstrating responsible borrowing and timely repayments on a payday loan with no credit check can enhance your prospects of accessing more diverse loan options in the future.

Cons

- Higher fees and interest rates – Payday loans with no credit check come with relatively higher fees and interest rates compared to standard loans. This is due to the increased risk that lenders assume when extending loans to individuals with unfavorable credit histories.

- Limited availability – Payday loans with no credit checks are not universally accessible in all states as some have implemented regulations that restrict the availability of these types of loans.

How Do Credit Scores Affect Payday Loans No Credit Check?

When it comes to applying for payday loans no credit check, the significance of credit scores is notably diminished. This means that even if you have a less-than-ideal credit history, you still have the opportunity to submit an application and secure a payday loan no credit check. Traditional financial institutions often reject loan applications from individuals with poor credit, categorizing them as high-risk borrowers.

While some lenders may perform credit checks, they typically use soft checks that are designed to enhance the chances of approval for those with less-than-perfect credit. Your credit history may not directly impact your eligibility for a payday loan no credit check, but it does play a role in your overall credit score. Timely repayment of the loan usually has a positive influence on your credit score.

For individuals burdened by negative credit histories or those without any credit history to speak of, payday loans no credit checks offer a valuable avenue to initiate or enhance their creditworthiness. By managing and repaying payday loans no credit checks responsibly, you can embark on the journey to establish a positive credit history.

Conclusion

In summary, payday loans with no credit checks present a unique financial option that can be a lifeline for those in immediate need of funds, especially when traditional lending avenues are inaccessible. Their appeal lies in their accessibility, speed, and flexibility. However, it’s vital to recognize that they come with elevated costs, and the potential for a debt cycle is a real concern. For this reason, you should approach these loans with a clear understanding of the terms, a well-thought-out repayment plan, and an awareness of the potential risks involved. While payday loans no credit checks serve as a valuable tool in times of crisis, responsible borrowing and careful consideration of alternatives should always be the guiding principles when considering payday loans with no credit checks. It is also worth looking at tribal loan lender loan options; you can read more about them in this article.

Frequently Asked Questions

Are there any alternatives to payday loans with no credit checks for people with bad credit?

Yes, there are alternatives to consider, such as credit union loans, personal installment loans, or exploring financial assistance programs. It’s advisable to explore these options and compare their terms before committing to a payday loan with no credit check.

What happens if I change my mind after accepting a payday loan offer?

If you change your mind after accepting a payday loan offer, you generally have a short window of time to cancel the loan without incurring any fees or interest charges. However, the specific cancellation policy may vary by lender, so it’s essential to check the terms and conditions.

Can I apply for multiple payday loans with no credit checks at the same time?

While it’s possible to have multiple payday loans simultaneously, it’s generally not advisable due to the increased risk of falling into a debt cycle. Lenders may have policies in place to prevent borrowers from taking out multiple loans concurrently.

What if I’m unable to repay my payday loan on the due date?

If you can’t repay your payday loan on the due date, contact your lender immediately. Many lenders offer options like loan extensions or rollovers, but these often come with additional fees. It’s essential to discuss your situation with your lender to explore the best solution.

- Email Support: support@lowcreditfinance.com

- Phone Number: 1-844-870-5672

Disclaimer and Affiliate Disclosure

This content is for informational purposes only and does not constitute financial advice, lending guidance, or an offer to provide financial services. The information presented has been prepared in good faith; however, no guarantees are made regarding the accuracy, completeness, timeliness, or relevance of the content. Loan terms, availability, eligibility criteria, and legal compliance may vary by state and lender, and are subject to change without notice.

Neither the publisher, its syndication partners, nor any third-party distributors are responsible for typographical errors, outdated information, or inaccurate representations. Readers should independently verify all loan details and consult with qualified professionals before making any financial decisions.

The publisher may receive compensation through affiliate partnerships featured in this content. This means commissions may be earned if readers click on links or take action based on the information provided. This compensation does not influence the content’s integrity, which is intended to present impartial and factual insights to the best of the publisher’s knowledge.

The publisher and all affiliated partners expressly disclaim any liability for losses, risks, or damages incurred—directly or indirectly—as a result of reliance on the information contained herein. The content is not authored by a financial institution or licensed lender and should not be interpreted as such.

By engaging with this content, readers agree to hold the publisher and all associated parties harmless from any claims, liabilities, or outcomes arising from the use or dissemination of this material.