New York, Jan. 28, 2026 (GLOBE NEWSWIRE) — The debate is over. CFOs aren’t asking whether to adopt AI in finance anymore. They’re asking why every solution forces them to choose between speed they can’t audit and control that doesn’t scale.

A new research study from Wakefield Research surveyed 100 CFOs at mid-market U.S. companies ($50M-$500M revenue). Between 60 and 77 percent already plan to adopt AI depending on the use case. But the findings reveal a massive trust gap blocking execution. Read the full report here: Finance AI Adoption Benchmarking Report.

Report cover: Finance AI Adoption Benchmarking Report.

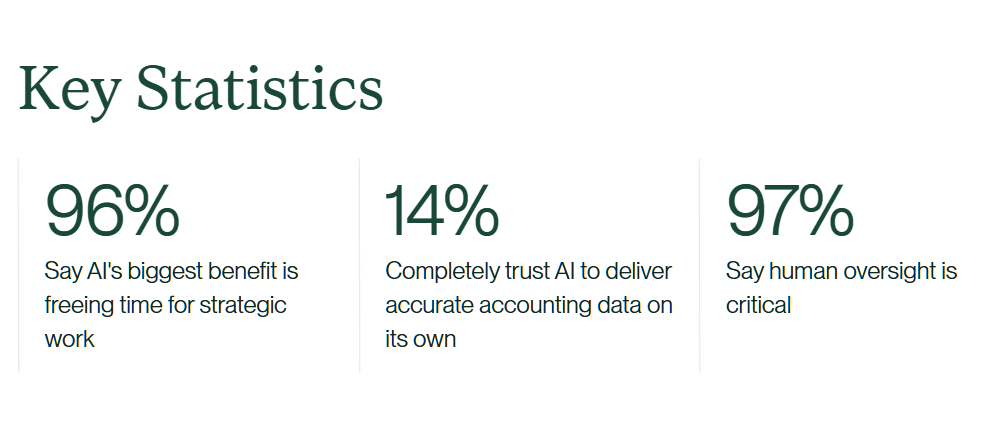

The trust gap is real. 96% of CFOs say AI’s biggest benefit is freeing time for strategic work. But only 14% completely trust AI to deliver accurate accounting data on its own. And 97% say human oversight is critical. That’s not a contradiction – it’s CFOs defining the solution.

The findings reveal a market stuck between two broken models. AI copilots – whether standalone or embedded in legacy tools – still require accountants to review transaction by transaction, delivering single-digit productivity gains. AI agents – black-box LLM wrappers with finance branding – promise full automation but deliver unacceptable risk: no way to verify accuracy, no real audit trail, and low understanding of business context.

CFOs want neither babysitting nor black boxes. They want what they are calling “intelligent escalation” – AI that operates autonomously on routine transactions but knows when it’s encountering ambiguity and escalates with full context. One CFO put it simply: “We need an autopilot – fast, accurate and with the sound judgment of our most reliable accountant.”

The bottleneck isn’t AI intelligence – it’s AI judgment. As foundation models get smarter, the differentiator isn’t raw capability – it’s understanding business context, company policies, and when a decision requires human input. Speed and accuracy are table stakes. Judgment is what separates automation from intelligent escalation.

“We evaluated several AI solutions, and the difference was night and day,” said Dominic Rand, CFO of Kiva Brands. “Most tools either wanted full control with zero transparency, or they created more work for my team. What we needed was what Maximor delivered: AI that could handle the routine with speed and precision and knew exactly when to bring a human into the loop. That’s when automation becomes a partnership, not a risk.”

“When intelligence becomes commoditized, judgment becomes the competitive advantage,” said Ramnandan Krishnamurthy, co-founder and CEO of Maximor. “CFOs aren’t asking for smarter AI – they’re asking for AI that knows its limits. They need systems that are verifiable, operate autonomously when appropriate, and demonstrate judgment about when to act and when to escalate. That’s the shift we’re seeing in the market.”

The study makes clear what finance leaders demand: speed, verifiable accuracy, full audit trails, and intelligent escalation – AI that earns the right to operate autonomously by demonstrating judgment about when to act and when to ask.

CFOs have drawn the line: AI that can’t show its work and doesn’t know when to escalate is unacceptable in finance.

About Maximor

Maximor is an AI-native finance automation platform that helps mid-market and enterprise companies run accounting and operational finance with speed and confidence, without replacing their ERP. Its proprietary Audit-Ready Agent architecture uses AI that knows when to act autonomously and when to escalate, producing fully verifiable outputs and decision traces for every action. Customers close their books faster, eliminate manual grunt work, and scale finance operations without adding headcount. Maximor is backed by Foundation Capital, Gaia Ventures, Boldcap, and leading industry operators. Learn more at maximor.ai.